October 19, 2011

Occupy Wall Street: An Economic History Lesson

by LUPA Advisory Council Chair John Davis

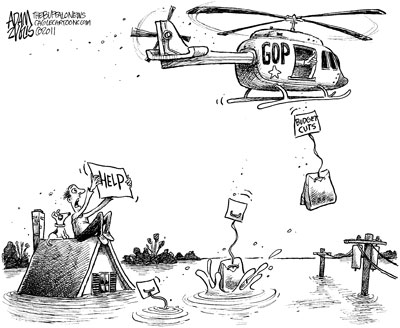

Since September there have been protests all over the country to combat the war being waged against working people in this country. The wealthy elite have been railing against the working class, using the Tea Party movement to spread their deception about the problems in the country. The “Occupy Wall Street “ movement has been holding rallies all across the country to raise awareness of the tricks and dastardly deeds by the robber barons residing on Wall Street.

However, the banking scandal, the home mortgage fiasco, and the subprime lending schemes are really nothing new. The crooks on Wall Street didn’t pioneer any of these ideas - they have simply been running the same plays the 18th century robber barons developed. Padding their pockets at the expense of the working class has become the game of choice for the wealthiest 1%, with history recording the deeds of the corporate moguls.

Andrew Carnegie immigrated to the United States from Scotland as a child and worked his way up to eventually owning Carnegie Steel. Along the way he worked as a broker on Wall Street selling railroad bonds for huge commissions and became a millionaire. It was from this fortune that he created Carnegie Steel, using the government to help his endeavors. He went to England and learned the Bessemer method of steel production, came back and built mills and had the government place tariffs on imported steel to keep out foreign competition. He bought up his competitors to create a monopoly and was making $40,000,000 a year by 1900.

That was the same year that New York banker J.P. Morgan approached Carnegie about merging with several other steel companies to form U.S. Steel. The companies merged and went public with Morgan handling the selling of the stocks for the new company- eventually keeping $150,000,000 for himself for brokering the deal. The problem with U.S. Steel was Morgan sold $400,000,000 more in stock than the company was worth.

Stock holders must be paid dividends, so the only way U.S. Steel could cover the inflated $400,000,000 price tag was to bump profits to cover the extra stock holders. U.S. Steel had $1.3 billion in stocks, but was only worth about $700,000,000. This meant the company’s value would have to grow by a third to cover the extra shares that Carnegie and Morgan pocketed. Naturally, the first place they turned to milk the money was the 200,000 workers who toiled for U.S. Steel.

Workers toiled in the mills for 12 hours on pay so meager they could barely feed their families. Carnegie mills were no stranger to labor strife. Back in 1892 the workers at the Carnegie  Homestead Mill in Homestead, Pennsylvania. The mill had seen an increase of profit by 60% and the workers felt they deserved a raise. Carnegie had left Henry Frick in charge of the mill and instructed him to use the negotiations as a tool to bust the union. When the mill offered a small wage increase, the union refused and continued to bargain. On the night of June 28, 1892, the company locked out the workers and tried to send in non-union workers using the Pinkerton Security agency. A battle erupted and ten men were killed. The battle between Carnegie and the workers dragged on for 143 days. Homestead Mill in Homestead, Pennsylvania. The mill had seen an increase of profit by 60% and the workers felt they deserved a raise. Carnegie had left Henry Frick in charge of the mill and instructed him to use the negotiations as a tool to bust the union. When the mill offered a small wage increase, the union refused and continued to bargain. On the night of June 28, 1892, the company locked out the workers and tried to send in non-union workers using the Pinkerton Security agency. A battle erupted and ten men were killed. The battle between Carnegie and the workers dragged on for 143 days.

So U.S. Steel was not worker friend and recouped the extra $400,000,000 on the backs of the workers and by manipulating the government. The monopoly allowed U.S. Steel to charge what it wanted without fear of competition and at the expense of their workers. Andrew Carnegie spoke often of “his support of workers to organize” but his business dealings proved he did not support labor.

The actions of Carnegie and Morgan are being repeated today. From 1979 to 2009, the Economic Policy Institute reports productivity in this country rose 80%. Worker compensation during the same time rose only 10% for median workers, with the bulk of that occurring in the 1990s. In the past ten years worker’s wages have been stagnant. By comparison, here are five facts about the wealth of the wealthiest 1% according to a recent study by Zaid Jilani of Think  Progress: Progress:

- The wealthiest 1% hold 42% of all national wealth. By comparison the BOTTOM 80% hold 7% of the national wealth.

- The wealthiest 1% take home 24% of the annual national income. In 1976 the wealthiest 1% took home 9% of all income. They have tripled they share of the annual income pie in 30 years.

- The wealthiest 1% of Americans hold 50% of all stocks, bonds and mutual funds. The bottom 50% hold just .5%.

- The wealthiest 1% hold just 5% of the national debt. The bottom 90% hold 73% of the national debt.

- The wealthiest 1% is currently taking in more of the national wealth since any other time since the 1920s. We know how that turned out.

The actions of Carnegie and Morgan, along with their friends in government led to the Great Depressions through the redistribution of wealth from the working class to the wealthy. There are those in Washington who would have us believe that lower taxes on the wealthy and fewer regulations will fix the economy. All it takes is an economy history lesson to see the folly in that type of thinking. |