January 29, 2012

Mitt Romney’s 15% Tax Issue

By Region 8 Webmaster and LUPA Advisory Council Chair John Davis

In the South Carolina Republican Primary, candidate Newt Gingrich hammered Mitt Romney with ads paid for by a Las Vegas casino owner. He hit Romney over and over concerning his tax rate and his income tax returns. Of course Newt Gingrich crying foul to anyone is laughable.

According to Romney’s tax return he earned $20 million last year, making him one of the richest presidential candidates in generations. Since the bulk of his income is from capital gains, Romney only paid 14% income tax last year. When you compare that to the 28% that most middle class families pay, it is safe to assume that this is a problem for a man vying to be your next president.

However, in all fairness to Romney, he isn’t beating the system just using it, and that is where the rub comes. Capital gains are part of the tax system, which began in 1862 as Congress established a federal tax on income to fund the Civil War. In 1913 the 16th amendment to the constitution made income tax a permanent fixture in financing the government. This law established tax rates for both individuals and corporations. Part of the tax structure is capital gains, or income made from (1) the sale of non-residential property (investment  property), (2) closely held business (a business owned by an individual with the tax covering the profit of that business not the gross sales) and (3) investment income from stock dividends (this includes buying and selling stocks and the dividends earned from holdings in these companies.) property), (2) closely held business (a business owned by an individual with the tax covering the profit of that business not the gross sales) and (3) investment income from stock dividends (this includes buying and selling stocks and the dividends earned from holdings in these companies.)

From the beginning, capital gains rates ran well behind that of payroll taxes, with the idea that capital gains are made from the investment of income that has already been taxed. The capital gains tax rate fluctuated from 20 to 28% depending on which party held Congress. However, in 2003 capital gains tax rates were lowered to 15% as part of the Bush Administrations overhaul of the tax code. This was the lowest rate in history, passed by a Republican President, Republican Congress and Republican Senate – contrary to a Fox News report this week that stated the Democrats set the rate.

However, the argument that capital gains should be lower because the money has already been taxed once doesn’t hold water. For example, a real estate speculator can buy real estate and sell it for a profit. This means they will pay 15% on their income from these sales while that same working class American who makes $35,000 a year pays 28%. A business owner who runs a successful business and makes say $400,000 in profit pays 15% federal income tax. Remember this tax is on net profit not gross. The Republicans like to make us believe a business owner pays taxes on his gross sales but that simply isn’t true. That leaves tax on stock dividends, and where Mitt Romney’s $20,000,000 income last year. While auto workers, school teachers, plumbers and truck drivers were paying 28% income tax, old Romney was paying less than 14%, with $3 million in taxes on income of $22 million.

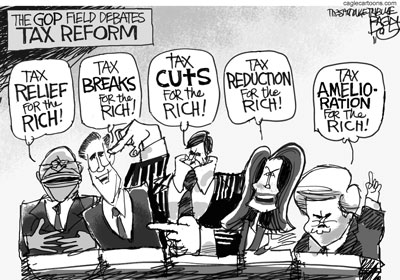

With the Bush tax cuts set to expire in 2013 – including the ridiculously low capital gains tax – it begs the question - “why would the richest man to run for president since the depression want to be president?” President Bush took office in 2000 with the largest surplus in history and quickly turned it into the largest deficit in history. The tax cuts were largely responsible for the current deficit and the redistribution of wealthy that was associated with it. Now both Romney and Gingrich want to make certain these tax cuts for the wealthy are made public.

All payroll taxes over $35,000 are taxed at 25%. With the rate rising the more you make to a maximum of 32%. That is provided it is payroll income or wages paid for providing a service. Recently the IRS released  some statics that showed of the wealthiest 400 individuals, 88 paid no payroll taxes. That means that close to one in four of American’s wealthiest individuals pay 15% income tax, while the working class is required to pay almost twice that amount on their income. As an added insult, factor in sales tax. Sales tax is the most unfair of all taxes because it based on the percentage of your income you spend- not on what you make. The working class spends virtually everything they make, so they are paying sales on 100% of their income. The wealthy only spend a portion of their income for the percentage of their total tax bill is much lower. For example, an individual makes one million dollars and spends $300,000. They pay sales tax on 30% of their income, while the working class family making $60,000 a year and spend all of it to live pay sales tax on 100% of their income. some statics that showed of the wealthiest 400 individuals, 88 paid no payroll taxes. That means that close to one in four of American’s wealthiest individuals pay 15% income tax, while the working class is required to pay almost twice that amount on their income. As an added insult, factor in sales tax. Sales tax is the most unfair of all taxes because it based on the percentage of your income you spend- not on what you make. The working class spends virtually everything they make, so they are paying sales on 100% of their income. The wealthy only spend a portion of their income for the percentage of their total tax bill is much lower. For example, an individual makes one million dollars and spends $300,000. They pay sales tax on 30% of their income, while the working class family making $60,000 a year and spend all of it to live pay sales tax on 100% of their income.

So why is all of this important? The next President will propose his own tax plan. President Obama has indicated he wants the Bush era tax cuts to expire to the wealthiest 2%. Candidate Mitt Romney has proposed skewing the tax code even further to benefit the wealthy. In 2010, Mitt Romney made $20,000,000 and paid an effective tax rate of 13.9% and a family of three making $55,000 paid an effective tax rate of 18%. The tax plan Romney has proposed will lower taxes on the wealthiest Americans by 20% and will raise taxes on the middle class by 40%. The tax plan he supports would save him an additional $3.5 million a year in taxes, shifting those government cost to the middle class – who already pay a much larger percentage of the tax burden than he does.

This could explain why the five largest banks in the country have donated more money to Mitt Romney than all other candidates combined. Usually financial institutions split their campaign money up to hedge their bets. However, so far the folks on Wall Street have sent 70% of their donation to Republicans.

Newt Gingrich has made Romney’s taxes an issue in these debates. However, Gingrich isn’t angry because Romney’s rates are too low- he is upset his aren’t that low. That is why candidate Gingrich is proposing a 15% tax rate across the board- which will hit lower middle class families hard while lowering his rate to that of Romney’s - this from a man with a credit line at Tiffany and Company Jewelry Store in New York City.

Some have accused the President of “creating a class war” in this year’s election. As billionaire Warren Buffett has stated “if there is a class war in this country- my class is winning.” Mitt Romney’s 15% tax problem isn’t just a problem for him. It is a problem for all of us and will be as long as deficits are at the center of the political debate in this country. |